In a startling revelation, Mr. Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reform Committee, has disclosed that Nigeria is currently collecting only 30% of its potential tax revenues, leaving a 70% gap. This significant shortfall poses a critical challenge to the country’s economic stability and development agenda.

The Tax Gap and Its Implications

Speaking at a recent forum, Mr. Oyedele underscored the magnitude of the problem, highlighting how the tax gap undermines Nigeria’s ability to fund essential infrastructure, social services, and economic programs.

“The amount we are leaving on the table is staggering,”

he noted.

“It’s imperative that we close this gap to foster sustainable development.”

The current tax collection inefficiency, compounded by a complex tax system, has limited the government’s capacity to deliver critical services, leaving the economy vulnerable to fiscal shocks.

Reform Agenda to Bridge the Gap

The Nigerian government is tackling this issue with an ambitious tax reform program. Key aspects of the initiative include:

- Simplification of Tax Laws: Efforts are underway to streamline over 60 official taxes and numerous unofficial levies into a more coherent framework, reducing confusion and fostering compliance.

- Lowering Tax Burden for Low-Income Earners: The reforms aim to ease the financial pressure on low-income households by exempting them from certain taxes.

- Higher Tax Contributions from the Wealthy: High-income earners will be subject to a 25% Personal Income Tax rate, ensuring a fairer distribution of the tax burden.

- Corporate Tax Adjustments: The corporate tax rate is set to drop from 30% to 25% over the next two years, fostering a business-friendly environment while maintaining revenue streams.

Challenges Ahead

Despite the ambitious plans, experts have raised concerns about the timing and execution of these reforms. Rising inflation, high unemployment rates, and economic hardships faced by Nigerians could complicate their rollout.

Legal expert Mike Ozekhome remarked, “The reforms are logical, but their timing may exacerbate the struggles of many Nigerians.”

Additionally, the sheer complexity of Nigeria’s tax system—with multiple layers of taxes—poses a significant challenge. Harmonizing these taxes while ensuring compliance will require robust policy enforcement and public engagement.

Government’s Commitment to Change

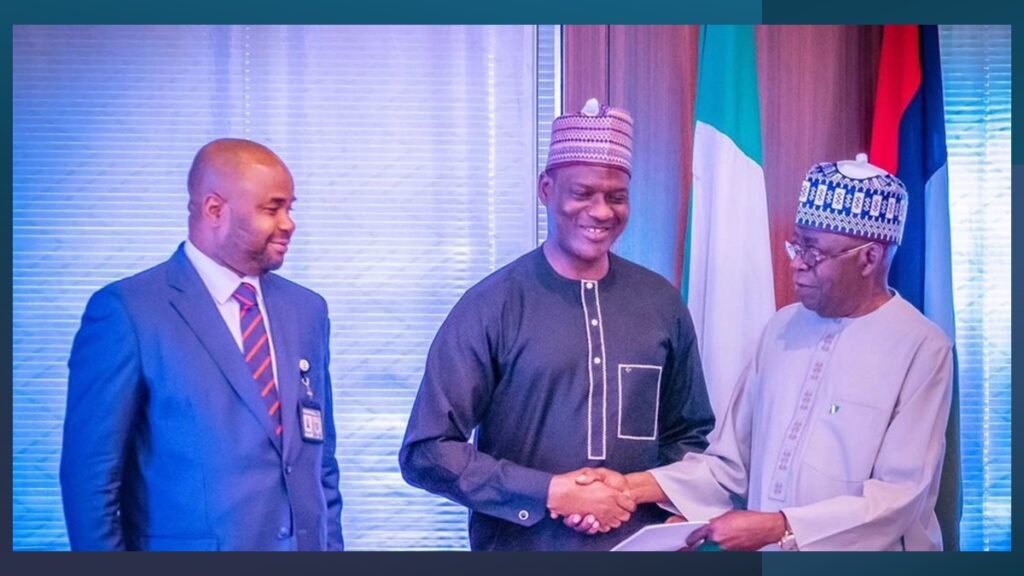

The tax reform initiative aligns with President Bola Ahmed Tinubu’s broader fiscal strategy to boost government revenues and reduce reliance on debt. The Presidential Fiscal Policy and Tax Reform Committee, under Mr. Oyedele’s leadership, has set an ambitious target of creating a more equitable, efficient, and sustainable tax system.

“We are not just reforming taxes; we are reimagining Nigeria’s economic future,”

Mr. Oyedele emphasized.

Conclusion

Closing the 70% tax gap could unlock billions of dollars in revenue for Nigeria, bolstering its ability to invest in critical infrastructure and improve the living standards of its citizens. However, achieving this goal will require bold reforms, careful timing, and collaboration between government agencies, businesses, and citizens.

As Nigeria embarks on this transformative journey, the world will be watching to see if the proposed reforms can deliver on their promise of fiscal sustainability and economic growth.