As global pressure mounts to combat climate change, industries worldwide are being pushed to adopt more sustainable practices. The cement industry, one of the largest contributors to greenhouse gas emissions globally, is under intense scrutiny. In Nigeria, major cement producers like Dangote Cement Plc, BUA Cement Plc, and Lafarge Africa Plc are beginning to grapple with the environmental impact of their operations. This article explores the environmental challenges facing Nigeria’s cement industry and examines the steps producers are taking to transition toward greener, more sustainable practices.

The Environmental Impact of Cement Production

1. Greenhouse Gas Emissions

Cement production is a significant source of carbon dioxide (CO2) emissions. Globally, the industry accounts for approximately 7-8% of total CO2 emissions, driven by:

- Limestone Calcination: The chemical process of converting limestone to clinker releases CO2.

- Fossil Fuel Combustion: High temperatures in kilns are achieved by burning coal, natural gas, or diesel.

2. Energy Consumption

- Cement production is energy-intensive, consuming vast amounts of non-renewable energy.

- In Nigeria, energy inefficiencies are exacerbated by reliance on diesel generators due to unreliable power supply.

3. Resource Depletion

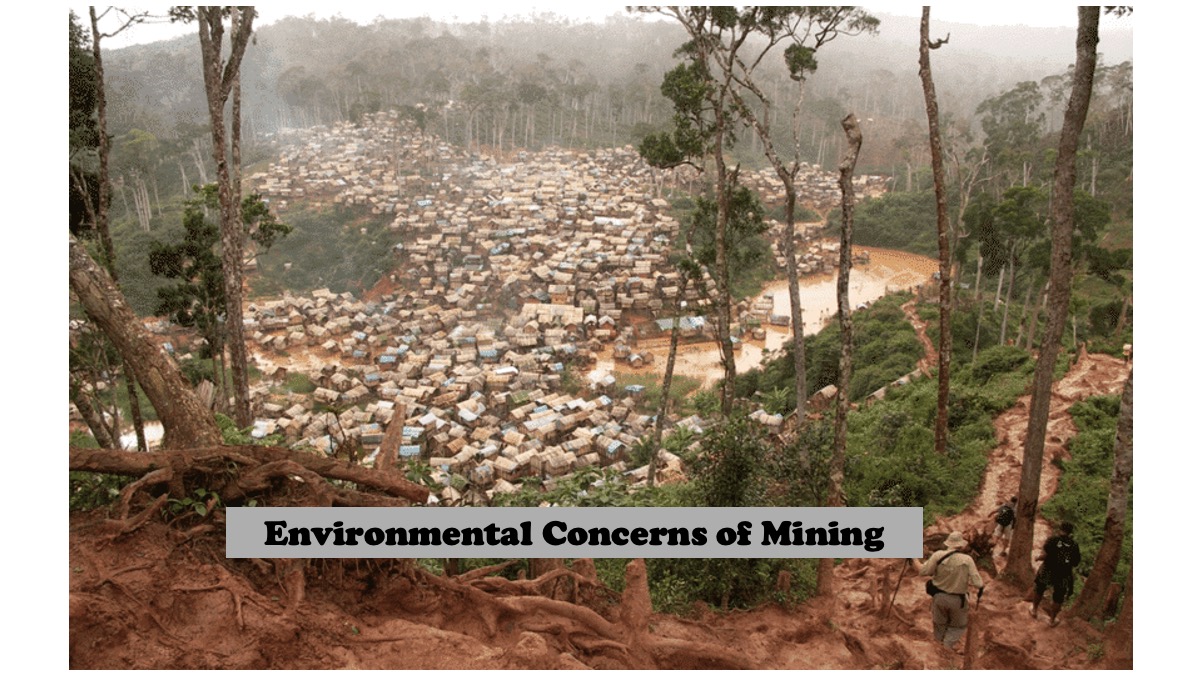

- Extracting raw materials such as limestone, clay, and gypsum can lead to habitat destruction and biodiversity loss.

- Quarrying operations alter landscapes and impact local ecosystems.

4. Waste Generation

- By-products such as dust and industrial waste contribute to air and water pollution.

- Poorly managed waste impacts local communities and ecosystems near production sites.

Impact: These environmental issues not only contribute to climate change but also pose reputational and regulatory risks for cement producers.

Key Environmental Challenges for Nigerian Cement Producers

1. Regulatory Pressures

- National Environmental Standards: Nigeria’s environmental regulations, such as emissions limits and waste management standards, are becoming stricter.

- Global Commitments: Nigeria’s commitment to the Paris Agreement puts pressure on industries to adopt carbon reduction strategies.

2. Stakeholder Demands

- Investors and customers increasingly prioritize companies with strong environmental credentials.

- Community advocacy against pollution and habitat destruction creates social and operational challenges.

3. Cost of Transition

- Adopting sustainable practices requires significant capital investment in technologies such as carbon capture, alternative fuels, and energy-efficient machinery.

- Smaller players in the industry may struggle to finance these initiatives.

Sustainability Initiatives by Industry Leaders

Dangote Cement Plc

- Alternative Fuels: Dangote is investing in biomass and waste-to-energy solutions to reduce reliance on coal and diesel.

- Carbon Reduction Targets: The company aims to cut its carbon footprint by optimizing clinker substitution and improving energy efficiency.

- Community Engagement: Dangote partners with local communities to rehabilitate quarries and promote biodiversity restoration.

BUA Cement Plc

- Energy Efficiency: BUA is retrofitting its plants with modern energy-saving technologies to reduce emissions and fuel consumption.

- Green Energy: The company has announced plans to integrate renewable energy sources, such as solar and wind, into its operations.

- Sustainable Products: BUA is developing eco-friendly cement blends that use less clinker, reducing emissions during production.

Lafarge Africa Plc

- Sustainability Leadership: As a part of the global Holcim Group, Lafarge has a strong focus on sustainability.

- Green Cement: The company produces a range of low-carbon cements, including those with reduced clinker content.

- Waste Utilization: Lafarge’s co-processing technology converts industrial waste into fuel, reducing reliance on fossil fuels.

Opportunities for Greener Practices

1. Clinker Substitution

- Replacing clinker with supplementary materials such as fly ash, slag, or pozzolans can significantly reduce CO2 emissions.

- Nigerian producers can explore the use of locally available materials to develop sustainable cement blends.

2. Renewable Energy Adoption

- Transitioning to solar, wind, or biomass energy can reduce dependence on fossil fuels.

- Incentives and partnerships with renewable energy providers can make this transition cost-effective.

3. Carbon Capture and Storage (CCS)

- CCS technologies can capture CO2 emissions from cement kilns and store them underground.

- While expensive, government support and international funding can make CCS viable for Nigerian producers.

4. Circular Economy Practices

- Co-processing industrial and agricultural waste as alternative fuels minimizes waste and lowers emissions.

- Recycling construction and demolition waste into raw materials for cement production promotes sustainability.

Global Benchmarks and Lessons

1. Europe’s Green Cement Revolution

- Companies like HeidelbergCement and Holcim are leading the way with net-zero carbon goals and large-scale CCS projects.

- Nigerian producers can learn from these companies’ investments in green technologies and partnerships.

2. India’s Energy Efficiency Programs

- Indian cement producers have implemented energy audits and optimized kiln operations to reduce emissions and costs.

- Similar programs in Nigeria could drive efficiency and sustainability.

Challenges to Going Green

1. Financial Constraints

- High capital costs of green technologies are a significant barrier, especially for smaller players.

- Limited access to low-cost financing makes it difficult for companies to invest in sustainability initiatives.

2. Infrastructure Deficits

- Nigeria’s unreliable power supply complicates the integration of renewable energy into cement operations.

- Lack of infrastructure for waste collection and processing limits the adoption of circular economy practices.

3. Technological Gaps

- Advanced technologies like CCS are not widely available in Nigeria, requiring significant knowledge transfer and expertise.

- Local adaptation of global solutions is necessary to address Nigeria’s unique environmental and economic conditions.

The Path Forward

Collaboration and Partnerships

- Public-private partnerships can fund large-scale green initiatives, such as renewable energy plants and CCS projects.

- Collaboration with international organizations can provide access to expertise, funding, and technology.

Incentives for Sustainability

- The government can offer tax breaks and subsidies for companies investing in green technologies and renewable energy.

- Carbon credits and trading schemes can reward producers for reducing emissions.

Consumer Awareness

- Promoting the benefits of green cement to consumers can drive demand and justify investments in sustainability.

- Educational campaigns can highlight the role of sustainable construction in combating climate change.

Conclusion

Nigerian cement producers face an urgent challenge: to balance profitability with sustainability in an increasingly environmentally conscious world. Companies like Dangote Cement, BUA Cement, and Lafarge Africa have taken initial steps toward greener operations, but more ambitious action is needed to meet global and national climate goals.

By investing in renewable energy, adopting circular economy practices, and collaborating with stakeholders, Nigerian cement producers can position themselves as leaders in sustainable construction. While the path to green cement production is fraught with challenges, it also presents opportunities for innovation, efficiency, and long-term growth. The question remains: can Nigeria’s cement industry embrace change quickly enough to stay ahead of environmental and market demands?

Leave a Reply